College & Financial Aid Planning

If you currently manage your money or use a different adviser, you might have doubts or questions. Or perhaps you are just looking for a second opinion on your investment portfolio. You have come to the right place.

We offer a wide range of estate of estate and trust planning services including:

- Will and trust creation: We'll work with you to create a personalized estate plan that reflects your goals and values, including wills, trusts, and other legal documents as needed. This will include reviewing the benefits of an irrevocable trust.

- Beneficiary designations: We'll help you consider the most tax-efficient way to designate your assets to your loved ones, ensuring that your assets are passed on in accordance with your wishes.

- Estate tax planning: We'll help you minimize the taxes your estate will owe, maximizing the assets that are available for your loved ones. This will include defining liquid assets to satisfy estate taxes. This will include reviewing your Federal Unified Estate and Gift Tax Credit and any applicable state credits.

- Trust administration: If you've been named as a trustee, we can provide guidance on your responsibilities and help you manage the trust assets effectively.

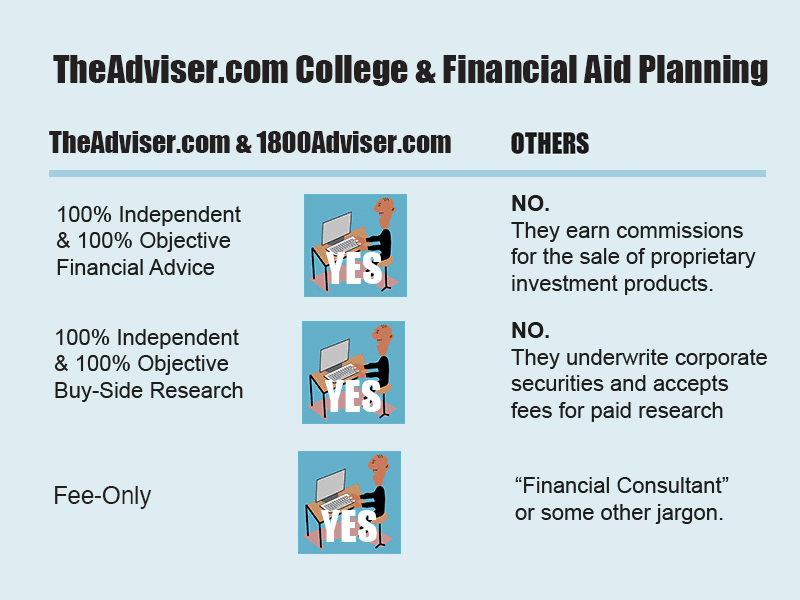

Our team of FEE-ONLY financial advisers is here to guide you through the complex world of estate and trust planning, offering personalized, professional advice that is tailored to your needs.

Each of our professionals maintains their own pricing structure and fees are based on the complexity of your estate and trust plan. A simple will can cost as low as $200 in some states but for more complex estates, comprehensive services can range from $5,000 to $25, 000 - if not more. All fees will be discussed in advanced and agreed to you with you in writing.

If you are ready to learn more Click Here to Schedule a FREE Consultation. Alternatively, visit 1800ADVISER.COM to browse biographies of individual advisers and choose one or more to connect with.